How to apply for housing using your company EIN number? It’s a question many business owners face, especially when securing housing for employees or company-sponsored projects. This guide breaks down the process, clarifying the differences between using an EIN versus an SSN for housing applications and guiding you through each step. We’ll cover everything from finding eligible housing programs to navigating potential challenges and ensuring a smooth application process.

Let’s dive in!

Understanding the nuances of using an Employer Identification Number (EIN) for housing applications is key. An EIN, unlike a Social Security Number (SSN), is used for business entities. This guide will explain when an EIN is necessary, what documents you’ll need, and how to complete the application process successfully. We’ll also explore different housing programs that accept EINs and provide practical advice for overcoming potential hurdles.

Understanding Company EIN and Housing Applications

Applying for housing can sometimes involve more than just your personal information. If you’re a business owner or self-employed, you might find yourself needing to use your Employer Identification Number (EIN) instead of your Social Security Number (SSN). Understanding the difference and when to use each is crucial for a smooth application process.

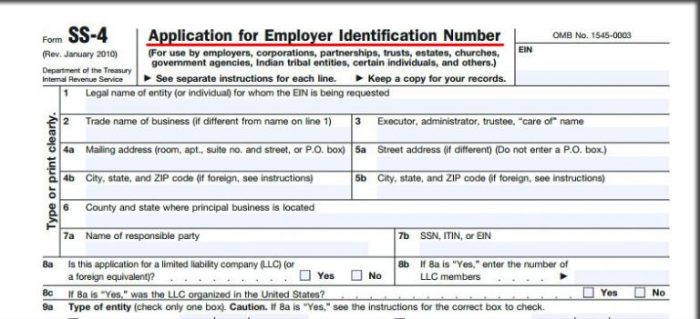

The Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is a unique nine-digit number assigned by the IRS to businesses operating in the United States. It’s used to identify your business for tax purposes and various other official interactions with the government. In the context of housing applications, the EIN acts as a business identifier, separating your business finances from your personal finances.

EIN versus SSN in Housing Applications

An EIN and an SSN serve very different purposes. Your SSN is a unique identifier tied to your personal identity and used for tracking your individual earnings and tax obligations. Conversely, the EIN is exclusively for your business. Using the correct number is vital to avoid delays and potential rejection of your application.

Situations Where an EIN Might Be Used Instead of an SSN

Several scenarios may require the use of an EIN instead of an SSN on a housing application. This is particularly relevant when the housing application involves a business entity rather than an individual.

| Situation | Why EIN is Used | Example | Relevant Documents |

|---|---|---|---|

| Business Owns the Property | The business is the legal entity responsible for the property and its financial obligations. | A corporation buys an apartment building to rent out units. | Business registration documents, EIN confirmation |

| Business is Leasing the Property | The business is the tenant, responsible for the rent and utilities. | A small business leases office space for its operations. | Business lease agreement, EIN confirmation |

| Self-Employed Applicant Using Business Income | The applicant’s income is derived from their business, and they’re using business income to qualify for housing. | A freelancer uses their business income to demonstrate financial stability. | Business tax returns, bank statements showing business income |

Comparison of EIN and SSN Use in Housing Applications

| Feature | EIN | SSN |

|---|---|---|

| Purpose | Identifies a business for tax and legal purposes. | Identifies an individual for tax and legal purposes. |

| Usage in Housing Applications | Used when a business is the applicant or guarantor, or when business income is used for qualification. | Used when an individual is the applicant or guarantor, and personal income is used for qualification. |

| Issuing Authority | Internal Revenue Service (IRS) | Social Security Administration (SSA) |

| Format | Nine-digit number | Nine-digit number |

Locating Relevant Housing Programs Accepting EINs

Source: corpnet.com

Finding housing programs that accept Employer Identification Numbers (EINs) for company-sponsored housing can significantly simplify the process for both employers and employees. Many programs exist, but understanding which ones are suitable requires research and a clear understanding of your company’s needs and the program’s eligibility requirements. This section will explore a few examples.

Remember, the availability and specifics of these programs vary greatly depending on location, the type of housing, and the company’s size and industry. Always verify the current requirements directly with the program administrator before applying.

Company-Sponsored Housing Tax Credits

Several tax credit programs incentivize companies to provide housing for their employees, often accepting the EIN as part of the application process. These credits can significantly reduce a company’s tax burden, making employee housing more financially viable.

- Eligibility Criteria: Generally, companies must meet specific requirements regarding the type of housing provided (e.g., affordable housing, workforce housing), the employee’s income level, and the duration of the housing assistance. The exact criteria vary significantly by state and federal programs.

- Key Requirements: Providing detailed documentation on the housing provided, employee eligibility, and the financial aspects of the program. The EIN is crucial for identification and tax reporting purposes.

- Benefits: Reduced tax liability, improved employee retention and recruitment, and potentially increased employee productivity.

Low-Income Housing Tax Credits (LIHTC) Programs with Employer Partnerships

While not directly accepting EINs for company applications, some Low-Income Housing Tax Credit (LIHTC) programs may work with companies to provide housing for their low-income employees. This often involves a partnership between the company and a LIHTC developer.

- Eligibility Criteria: The company would need to demonstrate a commitment to providing housing for its low-income employees, often through financial contributions or other forms of support. The employees themselves would need to meet income restrictions defined by the LIHTC program.

- Key Requirements: Collaboration with a LIHTC developer, documentation of employee income, and potential financial contributions from the company. The EIN would be used by the developer or in related financial reporting.

- Benefits: Access to affordable housing for employees, potential tax benefits for the company (indirectly through the developer’s tax credits), and improved community relations.

Rural Housing Programs with Employer Incentives, How to apply for housing using your company ein number

Some rural development programs offer incentives for companies to provide or support housing in rural areas, often facing housing shortages. These programs might indirectly consider the company’s EIN during the application or approval process.

- Eligibility Criteria: The company must typically operate in a designated rural area and demonstrate a need for housing to attract and retain employees. The program may also have requirements related to the type of housing provided and the wages offered to employees.

- Key Requirements: Detailed plans for the housing project, demonstration of the need for housing in the area, and potentially financial commitments from the company. The EIN would likely be required for any financial transactions or reporting.

- Benefits: Access to funding for housing projects, assistance in attracting and retaining employees in rural areas, and improved economic development in the community.

The Application Process

Source: falconexpenses.com

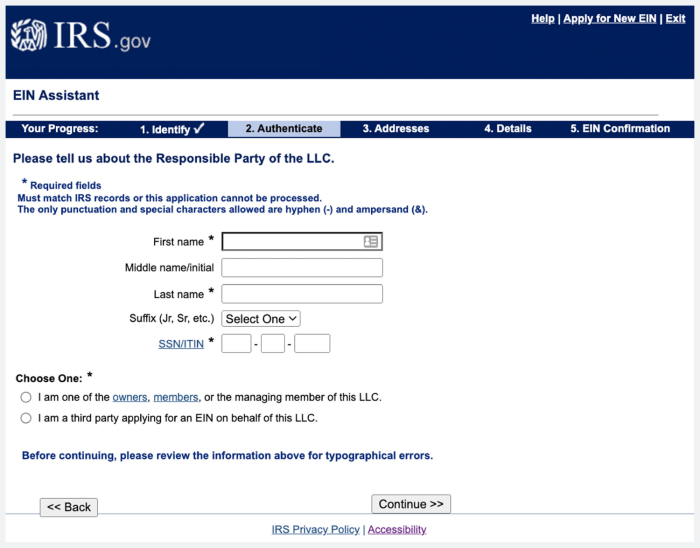

Applying for housing using your company’s EIN involves gathering specific documentation and following a structured application procedure. The process might vary slightly depending on the housing provider, but the core requirements remain consistent. Understanding these steps will streamline your application and increase your chances of approval.The primary purpose of providing your EIN is to establish your company’s financial standing and responsibility for the housing costs.

This often simplifies the verification process for landlords or housing authorities, as it provides a direct link to your business’s financial records.

Required Documentation

When applying for housing using a company EIN, be prepared to provide a comprehensive package of documents. This typically includes proof of your business’s legal existence, financial stability, and your company’s intent to use the property for legitimate business purposes. Missing any of these documents could delay or even prevent the approval of your application.

| Document Type | Description | Example | Importance |

|---|---|---|---|

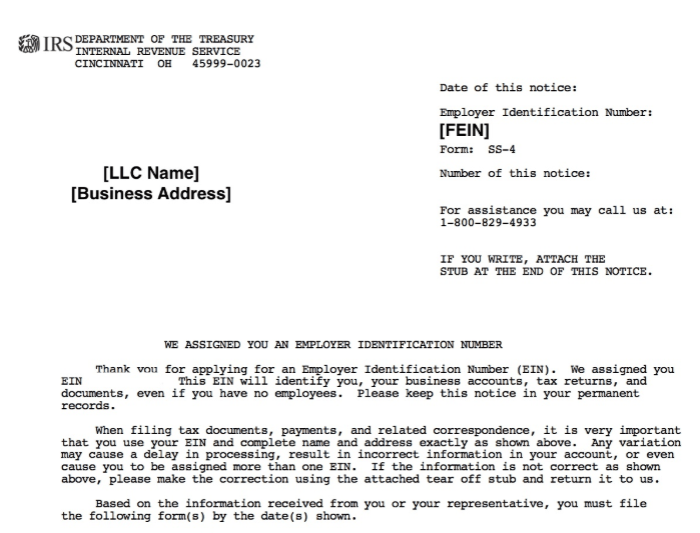

| EIN Verification | Proof of your company’s EIN. This could be a copy of your EIN letter from the IRS or a screenshot from the IRS website (with appropriate redactions for security). | [Image of EIN verification document – showing a clearly visible EIN number, but with other identifying information redacted for privacy. The image would show the IRS letterhead or a secure IRS website screenshot.] | Essential; verifies your company’s identity. |

| Articles of Incorporation/LLC Agreement | Official documentation proving your company’s legal registration. | [Image of a relevant page from the Articles of Incorporation – clearly showing the company name, registration date, and state of incorporation. Other irrelevant information could be redacted.] | Crucial; confirms your company’s legal standing. |

| Business Bank Statements | Recent bank statements demonstrating sufficient funds to cover rent and other housing-related expenses. | [Image of bank statement – showing the company name, account balance, and recent transactions. Sensitive account numbers should be redacted.] | Critical; proves financial capability to pay rent. |

| Business Tax Returns | Copies of your company’s recent tax returns (e.g., Form 1120, Form 1065). | [Image of a relevant page from a business tax return – showing the company name, tax year, and key financial information. Sensitive data like social security numbers should be redacted.] | Important; provides further evidence of financial stability. |

Application Submission Procedure

The application process usually involves completing a standard rental or housing application form, either online or in person. Your EIN will be a key piece of information required on this form. Ensure you accurately complete all sections, providing truthful and verifiable information. Inaccurate information can lead to application rejection.

1. Locate the Application

Find the appropriate application form from the housing provider’s website or request it directly.

2. Complete the Form

Fill out all sections accurately and completely. This includes personal and business information, references, and financial details.

3. EIN Placement

Enter your company’s EIN in the designated field on the application form. This is usually found in a section requesting business information or tax identification.

4. Gather Supporting Documents

Collect all the necessary documentation mentioned above.

5. Submit the Application

Submit the completed application and supporting documents according to the housing provider’s instructions. This might involve online submission, mailing, or in-person delivery.

Example Application Form

Below is a sample application form illustrating where you would enter your EIN. Remember that actual forms may vary.

| Applicant Name | Company Name | EIN | Contact Information |

|---|---|---|---|

| John Doe (Company Representative) | Example Corp | 12-3456789 | (555) 123-4567, [email protected] |

| Property Address Desired | Business Address | Desired Lease Start Date | Number of Employees |

| 123 Main Street | 456 Oak Avenue | 01/01/2024 | 10 |

Addressing Potential Challenges and Issues

Source: cloudfront.net

Using your company’s EIN for housing applications can streamline the process, but it’s not without potential hurdles. Understanding these challenges beforehand can help you navigate them effectively and increase your chances of a successful application. This section will Artikel common problems, their causes, and strategies for resolving them.

Several factors can complicate the use of an EIN in housing applications. The primary challenges often stem from the unfamiliar nature of using a business identifier for personal housing needs, leading to misunderstandings by both applicants and housing providers. Additionally, some programs might not be explicitly designed to accommodate EINs, leading to processing delays or rejections.

EIN Misinterpretation by Housing Providers

Some housing providers may be unfamiliar with using an EIN for housing applications, especially those geared towards individuals rather than businesses. This unfamiliarity can lead to delays as they attempt to verify the information or request additional documentation. This might involve repeated requests for clarification or even outright rejection due to a perceived lack of personal financial information. To mitigate this, proactively providing clear explanations of your situation and perhaps including supporting documentation like a letter from your accountant clarifying the use of your EIN for this specific purpose can be helpful.

In some cases, contacting the housing provider

before* submitting the application to clarify their EIN acceptance policies can prevent unnecessary delays.

Incomplete or Inaccurate Application Information

Errors in the application, even seemingly minor ones, can lead to delays or rejection. This is especially true when using an EIN, as the application may require additional information to link the EIN to your personal financial standing. For example, if you fail to correctly link your personal income to your company’s EIN, the application might be flagged for insufficient proof of income.

Double-checking all information before submission is crucial. Consider having a trusted individual review your application before submission to catch potential errors.

Insufficient Proof of Income or Assets

Housing providers often require proof of income and assets to ensure applicants can afford the housing. When using an EIN, this might require additional documentation compared to using a personal Social Security Number (SSN). You may need to provide detailed financial statements for your company, tax returns, and possibly a personal financial statement to demonstrate your ability to meet the financial obligations of the lease or mortgage.

Lack of proper documentation in this area is a common reason for rejection.

Troubleshooting EIN-Related Application Issues

A systematic approach to troubleshooting is vital when facing difficulties with your housing application. The following flowchart Artikels the steps to take when encountering problems related to your EIN.

Flowchart: Troubleshooting EIN Housing Application Issues

Start -> Application Rejected/Delayed? -> Yes: Review Rejection/Delay Notice -> Identify Issue (EIN Misinterpretation, Incomplete Information, Insufficient Proof of Income, Other) -> EIN Misinterpretation: Contact Housing Provider for Clarification, Provide Letter -> Incomplete Information: Correct Errors, Resubmit Application -> Insufficient Proof of Income: Provide Additional Financial Documentation (Tax Returns, Financial Statements) -> Other: Consult Housing Provider or Seek Professional Advice -> No: Application Approved -> End

Illustrative Examples of Successful Applications: How To Apply For Housing Using Your Company Ein Number

Source: googleusercontent.com

Let’s look at a real-world example of how using your company’s EIN can help secure housing. Understanding how this works through a case study will make the process clearer. We’ll examine a successful application, highlighting the key elements that contributed to its approval.Successful Application of Acme Corp. for Subsidized Housing

Acme Corp. Case Study

Acme Corp., a small landscaping business with three employees, needed affordable housing for its employees. They applied for a subsidized housing program offered by the city of Anytown, specifically designed for small businesses. Their application included their EIN (Employer Identification Number), which verified their business legitimacy and financial stability. The program prioritized businesses with a proven track record and a commitment to employee well-being.

Acme Corp. provided detailed financial statements, employment records, and a letter outlining their need for housing assistance to attract and retain skilled workers. The application process involved submitting all required documentation online, including a scanned copy of their EIN certificate. Anytown’s housing authority reviewed the application thoroughly, verifying the information provided against independent sources. Within four weeks, Acme Corp.

received approval for subsidized housing units for their employees.

Key Factors Contributing to Success

Several key factors contributed to Acme Corp.’s successful application. Firstly, their complete and accurate application, which included all necessary documentation, was crucial. Secondly, their strong financial standing, as demonstrated by their financial statements, played a significant role. The clear demonstration of a genuine need for employee housing and the positive impact it would have on the business also helped their case.

Finally, the timely submission of the application and proactive communication with the housing authority throughout the process ensured a smooth application journey. The EIN acted as a cornerstone of verification, confirming the legitimacy of the business and streamlining the process.

Visual Representation of a Successful Application Process

Imagine a flowchart. The first box is “Application Initiation,” showing Acme Corp. deciding to apply for the Anytown subsidized housing program. An arrow leads to the next box, “Gather Required Documents,” including financial statements, employment records, and the EIN certificate. Another arrow points to “Complete Application Form,” where the EIN is prominently displayed.

Next is “Submit Application Online,” depicting the online submission with the EIN acting as a key verification element. The following box is “Housing Authority Review,” showcasing the verification process and background checks using the EIN. The final box is “Approval and Housing Allocation,” signifying the successful outcome. Each step is connected by arrows illustrating the flow of the application process.

The EIN is visually highlighted in each relevant stage, emphasizing its crucial role in verifying the applicant’s identity and facilitating a smooth and successful application.

Legal and Regulatory Considerations

Source: lendingtree.com

Using your company’s EIN for housing applications involves navigating a legal landscape that varies depending on the specific housing program and your location. Understanding these regulations is crucial to avoid delays, denials, and potential legal repercussions. This section Artikels key legal considerations and compares the use of EINs versus Social Security Numbers (SSNs) in housing applications.The Fair Housing Act (FHA) is a cornerstone of federal housing law, prohibiting discrimination based on race, color, national origin, religion, sex, familial status, or disability.

While the FHA doesn’t explicitly mention EINs, it’s important to ensure that the use of an EIN in the application process doesn’t indirectly lead to discriminatory practices. For instance, focusing solely on an applicant’s corporate structure without considering other relevant factors could be construed as discriminatory if it disproportionately affects protected groups. State and local laws may also have additional regulations regarding housing applications and the use of EINs.

EIN vs. SSN in Housing Applications

The choice between using an EIN or an SSN for a housing application largely depends on the applicant’s status. Individuals applying for housing typically use their SSNs, as this is the standard identifier for personal financial information and credit history. Businesses or corporate entities, however, will use their EINs to demonstrate financial stability and ability to pay rent or mortgage payments.

The specific requirements will vary depending on whether the housing is for individual employees, company-owned housing, or corporate leasing arrangements. For example, a small business owner applying for a personal residence might use their SSN, while a large corporation leasing housing for its employees would utilize its EIN. Some housing programs may accept either an EIN or an SSN depending on the applicant’s situation and the nature of the housing application.

Consequences of Providing Incorrect EIN Information

Providing false or misleading information about your company’s EIN during a housing application can have serious consequences. This could lead to application rejection, penalties, or even legal action. In some cases, submitting fraudulent information could be considered a criminal offense. The severity of the consequences will depend on the nature of the misrepresentation and the specific laws in your jurisdiction.

For example, providing a non-existent EIN could result in immediate application rejection, while intentionally using an incorrect EIN to misrepresent the company’s financial standing could result in civil or criminal penalties. It’s crucial to ensure the accuracy of all information provided on the application, including the EIN.

Relevant Laws and Regulations

Beyond the Fair Housing Act, other relevant laws and regulations might apply depending on the type of housing and the applicant’s situation. These might include state and local landlord-tenant laws, regulations related to corporate leasing agreements, and rules specific to the housing program in question (e.g., public housing, subsidized housing, etc.). It’s advisable to review all applicable laws and regulations before submitting an application to ensure full compliance.

Consulting with legal counsel can be beneficial for navigating complex legal considerations, especially in cases involving substantial financial investments or unique circumstances.

Last Point

Source: evergreensmallbusiness.com

Securing housing using your company’s EIN can seem complex, but by understanding the process and having the right documentation, it becomes manageable. Remember to carefully review the requirements of your chosen housing program and address any potential challenges proactively. With thorough preparation and a clear understanding of the regulations, you can successfully navigate the application process and secure the housing you need.

This guide has provided a solid foundation; now, it’s time to put your knowledge into action!