How to buy a house under an LLC? It sounds complicated, but it can actually be a smart move for protecting your assets and potentially boosting your investment returns. This guide walks you through the entire process, from setting up your LLC to managing the property after purchase. We’ll cover everything from choosing the right LLC structure and securing financing to understanding the tax implications and navigating potential risks.

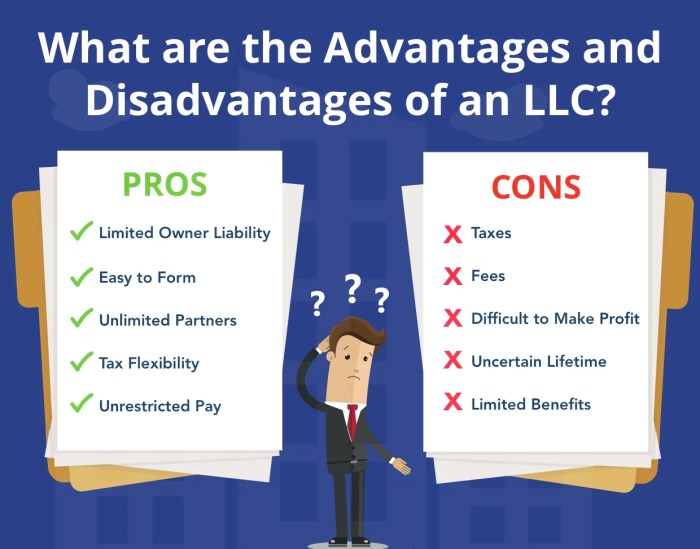

Buying a house through an LLC offers several advantages, including limited liability protection, which shields your personal assets from business debts or lawsuits related to the property. It can also simplify things if you plan to rent out the property, offering a clear separation between your personal finances and your business dealings. However, there are also some complexities, such as securing financing and navigating the legal requirements for LLC ownership of real estate.

This guide will help you understand those complexities and make informed decisions.

Legal Structures and Considerations for Real Estate LLCs

Source: co.uk

Forming a Limited Liability Company (LLC) to hold your real estate investments offers significant advantages, but choosing the right structure and navigating the legal requirements is crucial. This section Artikels the key legal considerations for setting up and operating a real estate LLC.

Types of LLCs and Their Suitability for Real Estate

Different states offer various LLC classifications, but the most common distinctions for real estate purposes are member-managed and manager-managed LLCs. In a member-managed LLC, all members participate in the management and decision-making. This structure is often simpler for smaller operations with a few involved parties. A manager-managed LLC, conversely, designates specific members or outside managers to handle the day-to-day operations, offering a more corporate-style structure better suited for larger, more complex real estate ventures.

The choice depends on the scale and complexity of your investment strategy. For instance, a single-family home purchase might be efficiently managed as a member-managed LLC, while a portfolio of properties or a large development project would benefit from the structure and accountability of a manager-managed LLC.

Legal Requirements for Forming an LLC

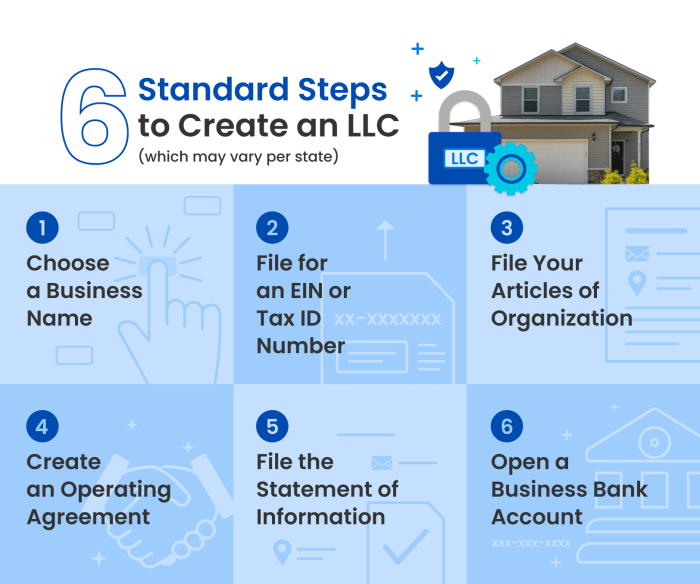

Forming an LLC involves several steps that vary slightly from state to state, but the core elements remain consistent. Generally, you’ll need to choose a name (complying with state regulations), appoint a registered agent (a designated individual or business to receive legal and official documents), file the articles of organization (a formal document outlining the LLC’s purpose and structure) with the state’s secretary of state or equivalent agency, and create an operating agreement.

Each state has specific filing fees and requirements; you should consult your state’s website or a legal professional for the most up-to-date information. For example, Delaware is known for its favorable LLC laws and is popular for its flexibility, but its fees may be higher than those in other states. Wyoming, on the other hand, is known for its low fees and limited information disclosure requirements.

Liability Protections Offered by Different LLC Structures, How to buy a house under an llc

The primary benefit of an LLC is its limited liability protection. This means that your personal assets are generally protected from business debts and lawsuits. However, the extent of this protection can vary depending on how the LLC is managed and operated. Piercing the corporate veil, where courts disregard the LLC’s separate legal entity and hold members personally liable, is a risk if the LLC is not properly maintained.

Maintaining strict adherence to corporate formalities, such as keeping separate bank accounts, holding regular meetings, and maintaining detailed records, is crucial to maximize liability protection. For example, commingling personal and business funds could jeopardize the LLC’s limited liability status.

Step-by-Step Guide to Registering an LLC for Real Estate

A step-by-step guide for registering a real estate LLC typically includes:

- Choosing a name that complies with state regulations.

- Appointing a registered agent.

- Filing the articles of organization with the Secretary of State.

- Creating an operating agreement.

- Obtaining an Employer Identification Number (EIN) from the IRS (if needed).

- Opening a business bank account.

Following these steps ensures compliance and sets up the LLC for effective operation.

Sample Operating Agreement for a Real Estate LLC

The operating agreement is a crucial internal document outlining the LLC’s management structure, member responsibilities, profit and loss distribution, and dispute resolution procedures. A well-drafted operating agreement protects the members’ interests and minimizes potential conflicts. A sample operating agreement might include sections on:

- Name and Purpose: Defining the LLC’s name and its primary purpose (e.g., real estate investment and management).

- Members’ Contributions: Specifying each member’s financial contributions and other forms of investment.

- Management and Operation: Detailing the management structure (member-managed or manager-managed) and outlining each member’s or manager’s responsibilities.

- Profit and Loss Distribution: Describing how profits and losses will be shared among the members.

- Member Withdrawals and Admission of New Members: Outlining the process for members to withdraw from the LLC or for new members to join.

- Dispute Resolution: Specifying a mechanism for resolving disagreements among members.

- Dissolution: Describing the process for dissolving the LLC.

Remember, this is a sample; a customized operating agreement tailored to your specific circumstances is recommended. Seeking legal counsel is advisable to ensure the agreement accurately reflects your intentions and complies with applicable laws.

Financing a House Purchase Through an LLC

Source: website-files.com

Buying a house through an LLC offers potential tax and liability benefits, but financing can be more complex than a traditional individual purchase. Understanding the available options and the lender’s requirements is crucial for a smooth transaction. This section Artikels the key aspects of securing financing for your LLC’s real estate acquisition.

Financing Options for LLCs

LLCs have several financing avenues available when purchasing property. These generally fall under commercial or residential loan categories, each with its own set of requirements and implications. The best option depends on factors such as the LLC’s credit history, the property’s purpose (investment or personal use), and the loan amount. Common options include commercial mortgages, SBA loans (if the LLC qualifies as a small business), private money lending, and potentially even some residential mortgages depending on lender policies and the specifics of the LLC’s structure and purpose.

Commercial Loans versus Residential Loans for LLCs

Commercial loans are typically used for investment properties and are often characterized by higher interest rates and stricter lending requirements compared to residential loans. Lenders assess the LLC’s financial health, including its credit score, revenue, and debt-to-income ratio, more rigorously for commercial loans. Residential loans, while sometimes available to LLCs, are usually reserved for properties intended for personal use by the LLC’s members.

Securing a residential loan for an LLC may be challenging and often requires demonstrating a strong connection between the LLC and the property’s intended use as a primary residence. The documentation requirements for both are extensive but differ in the specifics.

Documentation Required by Lenders

Lenders require extensive documentation from LLCs applying for mortgages. This typically includes the LLC’s articles of organization, operating agreement, tax returns (both personal and business), bank statements, proof of income, and personal credit reports of the LLC’s members (especially the managing members). They will also need a detailed appraisal of the property, and in some cases, a business plan outlining the LLC’s financial projections for the property.

The exact requirements can vary between lenders and loan types.

Improving an LLC’s Creditworthiness

Improving the LLC’s creditworthiness is key to securing favorable loan terms. This involves establishing a strong credit history for the LLC itself, which often means maintaining consistent positive financial activity. This includes paying all business bills and taxes on time, maintaining sufficient operating capital, and keeping accurate financial records. Furthermore, demonstrating a stable revenue stream and a low debt-to-income ratio will significantly enhance the LLC’s appeal to lenders.

Improving the personal credit scores of the managing members can also indirectly improve the LLC’s chances of securing a loan.

Comparison of Lender Loan Terms

The following table offers a hypothetical comparison of loan terms from different lenders. Note that these are examples and actual rates and terms can vary greatly based on several factors, including the lender, the property’s location and value, and the LLC’s financial standing.

| Lender | Interest Rate (APR) | Loan Term (Years) | Down Payment Requirement |

|---|---|---|---|

| Example Lender A (Commercial) | 7.5% | 25 | 25% |

| Example Lender B (Commercial) | 8.0% | 30 | 20% |

| Example Lender C (Residential, if available) | 6.0% | 30 | 10% |

| Example Lender D (SBA Loan) | 6.5% | 20 | 15% |

Tax Implications and Financial Management: How To Buy A House Under An Llc

Source: nestapple.com

Owning a house through an LLC introduces a layer of complexity to your tax situation, but also offers potential advantages for minimizing your tax liability. Understanding these implications and managing your LLC’s finances effectively are crucial for maximizing your return on investment. This section will Artikel the key tax considerations and provide practical strategies for financial management.

Tax Implications of Owning a House Through an LLC

The IRS treats an LLC as a pass-through entity for tax purposes unless it elects to be taxed as a corporation. This means that profits and losses from the LLC are passed through to the owners’ personal income tax returns. However, the specific tax implications depend on several factors, including the type of LLC (single-member or multi-member), the state of registration, and how the property is used (e.g., rental property, primary residence).

You’ll need to carefully track income and expenses associated with the property, separating them from your personal finances. For example, mortgage interest and property taxes are generally deductible expenses, but the rules can be nuanced, particularly for rental properties. Consulting with a tax professional is highly recommended to ensure compliance with all applicable regulations.

Deducting Property-Related Expenses

Several expenses related to your LLC-owned property are potentially deductible, helping to reduce your overall tax burden. These include mortgage interest, property taxes, insurance premiums, maintenance and repairs, depreciation (for rental properties), and professional fees (e.g., accounting, legal). It’s crucial to maintain meticulous records of all expenses, including receipts and invoices, to support your deductions during tax season. Accurate record-keeping is essential for avoiding potential IRS audits and ensuring you claim all legitimate deductions.

Depreciation, specifically, is a significant deduction for rental properties, allowing you to gradually deduct the cost of the property over its useful life. However, the depreciation rules are complex and vary depending on the type of property and its use.

Strategies for Minimizing Tax Liability

Effective tax planning is vital when owning real estate through an LLC. One strategy is to maximize deductible expenses, as Artikeld above. Another is to structure your LLC to minimize your tax burden. For instance, choosing the right type of LLC (single-member or multi-member) can impact how profits and losses are taxed. Furthermore, understanding and utilizing tax credits, such as those available for energy-efficient improvements, can further reduce your tax liability.

Finally, regularly reviewing your tax situation with a tax advisor is highly recommended to ensure you are taking advantage of all available deductions and credits and to stay updated on any changes in tax laws. Proactive tax planning can save you significant money in the long run.

Managing LLC Finances Effectively

Effective financial management is crucial for the success of your LLC. This involves establishing a separate business bank account for the LLC to keep its finances separate from your personal accounts. This separation simplifies accounting, streamlines tax preparation, and protects your personal assets from business liabilities. Regularly reconcile bank statements, and maintain detailed records of all income and expenses.

Consider using accounting software designed for small businesses to manage your finances more efficiently. This software can automate tasks, generate financial reports, and track your cash flow effectively. Regularly review your financial statements to monitor the LLC’s performance and identify areas for improvement.

Sample Budget for a Rental Property Owned by an LLC

This is a simplified example and actual figures will vary based on the property’s location, value, and rental income.

| Income | Monthly Amount |

|---|---|

| Rental Income | $2,500 |

| Expenses | Monthly Amount |

| Mortgage Payment | $1,200 |

| Property Taxes | $200 |

| Homeowners Insurance | $100 |

| Maintenance & Repairs | $150 |

| Utilities (if paid by LLC) | $100 |

| Property Management Fees (if applicable) | $250 |

| Accounting Fees | $50 |

| Total Expenses | $2,050 |

| Net Income | $450 |

Note: This budget is a simplified example. Always consult with a financial professional for personalized advice.

Managing the Property After Purchase

Source: co.uk

Owning a property through an LLC adds a layer of complexity to property management, but with a structured approach, you can efficiently handle all aspects. This section Artikels key responsibilities and strategies for successful property management, focusing on tenant management (if applicable), maintenance, insurance, taxes, and financial record-keeping.

Tenant Management Strategies

Finding and managing reliable tenants is crucial for rental properties. Thorough tenant screening is paramount, including credit checks, background checks, and verification of employment and rental history. Clear lease agreements outlining responsibilities, rent payments, and lease terms are essential. Regular communication with tenants, prompt responses to maintenance requests, and adherence to fair housing laws are also critical for maintaining positive tenant relationships and minimizing legal issues.

For example, a well-written lease agreement clearly outlining late fee policies can help mitigate financial risks associated with late rent payments. Using a property management software can streamline communication and tracking of tenant information.

Property Maintenance and Repair Procedures

Regular property maintenance is essential for preserving property value and tenant satisfaction. This includes routine inspections, preventative maintenance (e.g., HVAC system checks, gutter cleaning), and prompt repairs. Establishing a system for tracking maintenance requests, assigning tasks to contractors, and managing repair costs is key. For instance, creating a spreadsheet to log all maintenance issues, including date reported, description, contractor assigned, cost, and completion date can help maintain a clear overview of maintenance activities.

Having a pre-approved list of reliable contractors for various repairs can ensure efficient and cost-effective solutions when issues arise.

Insurance and Property Tax Handling

Adequate insurance coverage is vital to protect your investment. This includes property insurance to cover damage from fire, weather, or other unforeseen events, and liability insurance to protect against lawsuits from tenant injuries or property damage. Staying current with property taxes is also crucial to avoid penalties and liens. Setting up automatic payments for both insurance premiums and property taxes can simplify the process and prevent late payments.

Reviewing your insurance policy annually to ensure it aligns with the property’s value and your needs is a proactive approach to risk management.

Income and Expense Tracking System

Accurate financial record-keeping is essential for tax purposes and for monitoring the property’s financial performance. A dedicated accounting system, either manual or software-based, should be used to track all income and expenses. This includes rent payments, maintenance costs, insurance premiums, property taxes, mortgage payments (if applicable), and any other relevant expenses. Categorizing expenses for tax purposes (e.g., repairs vs.

capital improvements) is important. Regularly reviewing financial statements can provide insights into the property’s profitability and help identify areas for improvement. For example, using accounting software allows for automated reporting and simplified tax preparation.

Potential Risks and Mitigation Strategies

Source: co.uk

Buying a house through an LLC offers benefits, but it also introduces unique risks. Understanding these risks and implementing proactive mitigation strategies is crucial for a successful real estate investment. Failing to do so can lead to significant financial and legal complications. This section Artikels potential pitfalls and provides practical solutions to help you navigate them.

Liability Risks and Asset Protection

Using an LLC to purchase a property offers a degree of liability protection, shielding your personal assets from business debts and lawsuits related to the property. However, this protection isn’t absolute. Piercing the corporate veil—where courts disregard the LLC’s separate legal entity and hold the owners personally liable—is a possibility if the LLC isn’t properly managed. Maintaining meticulous records, adhering to corporate formalities (such as holding regular meetings and keeping accurate minutes), and avoiding commingling personal and business funds are essential for preserving this limited liability.

Financial Risks and Funding Challenges

Securing financing for a property purchase under an LLC can be more complex than a personal purchase. Lenders often require more extensive documentation and may impose stricter lending terms. The LLC’s credit history, financial statements, and the property’s appraisal all play a significant role in loan approval. Furthermore, if the property’s income fails to cover expenses, the LLC faces financial strain.

Careful budgeting, securing sufficient reserves, and having a clear exit strategy are crucial for mitigating these risks. For example, a thorough market analysis before purchasing can help predict rental income and potential vacancies.

Legal and Regulatory Compliance

Navigating the legal landscape of real estate investment through an LLC requires careful attention to detail. Failing to comply with zoning regulations, building codes, or landlord-tenant laws can result in costly fines or legal battles. For instance, neglecting to obtain necessary permits before renovations can lead to stop-work orders and legal repercussions. Regularly consulting with legal and real estate professionals to ensure compliance is vital.

This proactive approach helps prevent unforeseen legal issues and protects the LLC’s assets.

Operational Risks and Property Management

Managing a property through an LLC introduces operational complexities. Finding reliable tenants, handling repairs and maintenance, and managing tenant relations require dedicated effort and expertise. Neglecting property upkeep can lead to decreased rental income and potential legal issues with tenants. Employing a property management company, or dedicating sufficient time and resources to property management, is crucial for mitigating these risks.

Having a well-defined lease agreement that clearly Artikels tenant responsibilities and expectations is also important.

Potential Problems and Solutions

The following list Artikels potential problems and their corresponding solutions:

- Problem: Insufficient funding for unexpected repairs or vacancies. Solution: Establish a robust reserve fund and secure a line of credit.

- Problem: Lack of understanding of landlord-tenant laws. Solution: Consult with a real estate attorney and stay updated on relevant regulations.

- Problem: Difficulty securing financing. Solution: Build a strong LLC credit history and prepare comprehensive financial documentation for lenders.

- Problem: Poor tenant selection leading to costly evictions. Solution: Implement a thorough tenant screening process and utilize a professional property management company.

- Problem: Failure to maintain proper LLC records. Solution: Maintain meticulous records of all financial transactions, meetings, and agreements.

Conclusion

Source: legalcounselingreviews.com

Purchasing a house under an LLC presents a unique set of opportunities and challenges. By carefully considering the legal structures, financing options, and tax implications, you can leverage the benefits of limited liability and streamline your real estate investment. Remember to thoroughly research your state’s specific requirements, seek professional advice when needed (like a lawyer and accountant), and develop a solid plan for managing the property long-term.

With careful planning and execution, buying a house under an LLC can be a rewarding experience.