How to prepare to buy a house in one year? It sounds daunting, right? But with a little planning and the right steps, owning your dream home within a year is totally achievable. This guide breaks down the process into manageable chunks, from assessing your finances and finding the perfect property to navigating the legal hurdles and planning for post-purchase expenses.

Get ready to turn that homeownership dream into a reality!

We’ll cover everything from boosting your credit score and saving for a down payment to understanding mortgage options and negotiating the best deal. We’ll also delve into the nitty-gritty details of property inspections, home insurance, and closing costs, ensuring you’re prepared for every step of the journey. Think of this as your ultimate checklist for a successful home-buying year.

Assessing Your Financial Situation

Source: boomtowncdn.com

Buying a house is a significant financial commitment, so understanding your financial standing is crucial before you even start browsing properties. This involves a thorough assessment of your income, debts, credit score, and savings, all within the context of your one-year timeframe. Let’s break down how to approach this.

Calculating Your Affordability

Determining how much house you can realistically afford involves more than just looking at your monthly income. Lenders use several key metrics, the most important being your debt-to-income ratio (DTI). This ratio compares your total monthly debt payments (including your potential mortgage payment) to your gross monthly income. A lower DTI is better, as it indicates you have more disposable income relative to your debt obligations.

Lenders typically prefer a DTI below 43%, but aiming for something lower (around 36%) improves your chances of securing a favorable mortgage rate.To calculate your DTI, first list all your monthly debt payments: credit cards, student loans, car payments, etc. Then add them up. Next, determine your gross monthly income (before taxes). Finally, divide your total monthly debt payments by your gross monthly income and multiply by 100 to express it as a percentage.

For example, if your total monthly debt is $1500 and your gross monthly income is $5000, your DTI is (1500/5000)100 = 30%. Remember to include estimated property taxes and homeowner’s insurance in your debt calculation when considering a mortgage.

Improving Your Credit Score

Your credit score significantly impacts your ability to secure a mortgage and the interest rate you’ll receive. A higher score means better terms. Here are some strategies to improve your credit score within a year:

- Pay all your bills on time: This is the single most important factor affecting your credit score. Even one missed payment can negatively impact your score.

- Keep your credit utilization low: Try to keep your credit card balances below 30% of your credit limit. Paying down existing debt is crucial.

- Don’t open multiple new accounts: Applying for several credit accounts in a short period can lower your score.

- Monitor your credit report: Regularly check your credit report for errors and address any inaccuracies promptly. You can get a free credit report annually from AnnualCreditReport.com.

Consistent and responsible credit management over the next year can lead to a substantial improvement in your score. Even a modest increase can translate into significant savings on interest payments over the life of your mortgage.

Mortgage Options and Implications

Several mortgage options exist, each with its own advantages and disadvantages. Understanding these options is essential for making an informed decision.

- Fixed-rate mortgages: These offer a consistent interest rate throughout the loan term, providing predictable monthly payments. They are generally preferred for stability.

- Adjustable-rate mortgages (ARMs): These start with a lower interest rate but can fluctuate over time, leading to unpredictable monthly payments. ARMs can be advantageous in the short term if rates are low, but carry more risk.

- FHA loans: These are government-insured loans designed to help first-time homebuyers with lower down payments and credit score requirements. They typically come with mortgage insurance premiums.

- VA loans: These are loans guaranteed by the Department of Veterans Affairs and are available to eligible veterans and military personnel. They often require no down payment.

The best mortgage option depends on your individual financial situation, risk tolerance, and long-term goals. It’s advisable to shop around and compare rates from multiple lenders.

Designing a Realistic Savings Plan

Accumulating a sufficient down payment is a crucial step in the home-buying process. The size of the down payment influences the mortgage amount you need, and therefore your monthly payments and overall cost of borrowing. A larger down payment often leads to better interest rates.To create a realistic savings plan, first determine the amount you need for a down payment (typically 20% of the home’s purchase price, but this can vary depending on the mortgage type).

Then, estimate your monthly savings capacity. Finally, develop a budget that allocates a specific amount each month towards your down payment goal. For example, if you need a $40,000 down payment and can save $1000 per month, you’ll reach your goal in 40 months. However, you’re aiming for one year, so you’ll need to adjust your savings or home price target accordingly.

Consider exploring ways to increase your income or cut unnecessary expenses to accelerate your savings.

Finding the Right Property

Source: squarespace-cdn.com

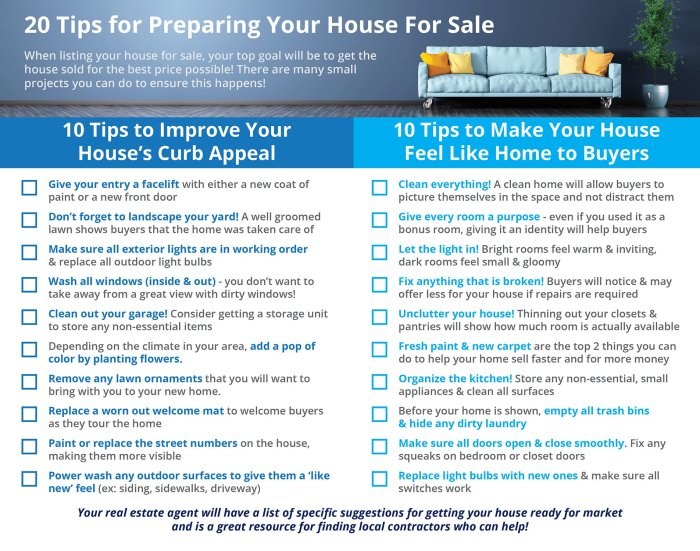

Buying a home is a significant investment, and finding the right property is a crucial step in the process. This section will guide you through researching neighborhoods, comparing property types, finding a real estate agent, and preparing for property viewings. Remember, this is a journey, and taking your time to make informed decisions is key.

Neighborhood Research and Location Selection

Choosing the right neighborhood involves more than just curb appeal. Consider factors like commute times to work and school, proximity to amenities (shops, restaurants, parks), school district quality (if applicable), crime rates, and property taxes. Websites like Zillow, Redfin, and Realtor.com offer detailed neighborhood information, including crime statistics and school ratings. Spend time driving around potential neighborhoods at different times of day to get a feel for the area’s atmosphere and traffic patterns.

For example, a neighborhood might seem quiet during the day but could be noisy at night due to nearby bars or traffic. Consider your lifestyle and priorities – do you prioritize walkability, access to nature, or a vibrant social scene? Matching your lifestyle to the neighborhood is crucial for long-term satisfaction.

Comparison of Property Types

Single-family homes, condos, and townhouses each offer distinct advantages and disadvantages. Single-family homes provide the most privacy and space but typically require more maintenance. Condos offer less maintenance responsibility and often include amenities like swimming pools or gyms, but come with homeowner association fees and potential restrictions on renovations. Townhouses offer a middle ground, with less maintenance than single-family homes but more privacy than condos.

The best choice depends on your budget, lifestyle, and maintenance preferences. For example, a young professional might prefer a low-maintenance condo near their workplace, while a family with children might prioritize the space and privacy of a single-family home in a good school district.

Finding and Working with a Real Estate Agent

A good real estate agent is invaluable during the home-buying process. They can provide expert advice, negotiate on your behalf, and help you navigate the complexities of the market. Ask friends and family for recommendations, and interview several agents before making a decision. A productive working relationship is built on trust and communication. Make sure you feel comfortable with your agent and that they understand your needs and preferences.

Discuss your budget, desired property type, and preferred neighborhoods upfront. Regular communication is key – expect updates on new listings and feedback after property viewings.

Essential Questions for Property Viewings

Before attending property viewings, prepare a list of essential questions. This ensures you gather all necessary information to make an informed decision. Ask about the age of the appliances, the condition of the roof and foundation, any recent renovations or repairs, and the history of any significant issues. Inquire about the property taxes, homeowner association fees (if applicable), and the availability of utilities.

Don’t hesitate to ask about the neighborhood, including crime rates and school performance. Finally, ask about the seller’s motivation for selling – understanding this can inform your negotiation strategy. For instance, a seller who needs to move quickly might be more open to negotiation.

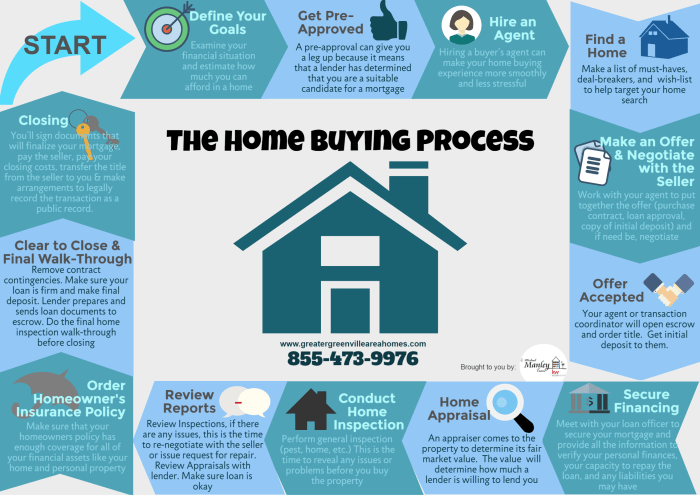

The Home Buying Process

Source: cloudfront.net

Buying a home is a significant undertaking, and understanding the process is crucial for a smooth and successful transaction. This section Artikels the key steps involved, from making an offer to closing on your new property. Remember, each step requires careful consideration and potentially professional assistance.

Making an Offer and Negotiating

Making an offer on a property involves more than just stating your desired price. A well-structured offer includes your proposed purchase price, earnest money deposit (a good-faith payment demonstrating your commitment), financing contingencies (allowing you to back out if you can’t secure a mortgage), inspection contingencies (allowing for a professional inspection and potential renegotiation based on findings), and a closing date.

Negotiation is common; the seller may counter with a different price or terms. A real estate agent can be invaluable in this process, guiding you through the complexities of negotiation and ensuring your offer is competitive and well-presented. For example, if the asking price is $300,000, you might offer $295,000, and be prepared to negotiate within a reasonable range.

The Home Inspection Process

A home inspection is a critical step, providing an objective assessment of the property’s condition. A qualified inspector will thoroughly examine the structure, systems (electrical, plumbing, HVAC), and appliances, identifying potential problems. The inspection report will detail any significant issues, allowing you to negotiate repairs with the seller or adjust your offer price accordingly. For instance, if the inspection reveals a faulty roof, you might ask the seller to pay for repairs or reduce the purchase price to cover the cost.

Ignoring this step could lead to costly repairs after you’ve purchased the home.

Home Insurance

Several types of home insurance exist, each offering different levels of coverage. Homeowners insurance is the most common, protecting your property from damage caused by fire, wind, or other covered perils. Flood insurance is separate and often required by lenders, especially in flood-prone areas. Additional coverage might include earthquake insurance or liability protection. Choosing the right policy depends on your location, the type of property, and your risk tolerance.

It’s advisable to compare quotes from multiple insurers to find the best coverage at a competitive price. For example, you might opt for a higher deductible to lower your premium, balancing cost with potential out-of-pocket expenses.

The Closing Process

Closing is the final step, where ownership of the property is transferred. This involves signing numerous documents, including the mortgage, deed, and closing disclosure. You’ll also pay closing costs, which include fees for appraisal, title insurance, and other services. A closing agent will oversee the process, ensuring all paperwork is in order and funds are transferred correctly.

Expect to bring a certified check or wire transfer for your down payment and closing costs. Thoroughly review all documents before signing to avoid any surprises. For example, the closing disclosure will detail all costs associated with the transaction, allowing you to verify that the final numbers match your expectations.

Closing Checklist

A well-organized checklist can help you stay on track throughout the closing process.

- Before Closing: Secure financing, obtain homeowners insurance, schedule a final walk-through of the property.

- During Closing: Review all documents carefully, ask questions if anything is unclear, and bring necessary funds.

- After Closing: Record the deed, change your address, and notify relevant parties of your new address.

Legal and Administrative Aspects

Source: greatnocohomes.com

Buying a home is a significant legal undertaking. Navigating the legal and administrative aspects correctly is crucial to ensure a smooth and successful transaction. Overlooking even minor details can lead to significant complications and potentially costly delays. This section will guide you through the key legal and administrative considerations.

Reviewing the Purchase Agreement

The purchase agreement is a legally binding contract outlining all the terms and conditions of the sale. It details the purchase price, closing date, contingencies (such as financing and inspections), and responsibilities of both the buyer and seller. Thoroughly reviewing this document with a legal professional is essential. Pay close attention to clauses regarding property disclosures, repairs, and the process for addressing any disputes.

Don’t hesitate to ask your lawyer to clarify anything you don’t understand; it’s better to be certain than sorry. Ignoring a crucial detail in the contract could have significant financial consequences later. For example, a poorly worded clause about the transfer of responsibility for property taxes could leave you with unexpected bills.

The Role of a Lawyer or Solicitor

Engaging a real estate lawyer or solicitor is highly recommended. They act as your advocate, protecting your interests throughout the entire process. Their expertise ensures you understand the legal implications of the transaction and that your rights are protected. They will review all documents, negotiate on your behalf, and ensure the legal aspects of the purchase are handled correctly. They can identify potential problems early on, preventing costly mistakes.

Think of them as your legal shield against unexpected issues and complexities in the home buying process. The cost of their services is a small price to pay for the peace of mind and protection they provide.

Essential Documents for Mortgage Application and Closing

Gathering the necessary documentation is a crucial step. A delay in providing the required documents can significantly delay the closing process. You’ll need to provide proof of income, assets, credit history, and employment. The exact documents required will vary depending on your lender and the type of mortgage, but generally include:

- Proof of income (pay stubs, tax returns, W-2s)

- Bank statements showing sufficient funds for down payment and closing costs

- Credit report

- Employment verification

- Government-issued photo identification

- Copy of the purchase agreement

Failure to provide complete and accurate documentation can result in delays or even rejection of your mortgage application. It is important to organize these documents well in advance of your application.

Potential Legal Issues and Their Resolution

Several legal issues can arise during the home buying process. These can range from title disputes (where there are questions about who legally owns the property) to issues with property surveys or zoning regulations. For example, a title search might reveal outstanding liens or encumbrances on the property. Your lawyer will help navigate these complexities, ensuring that any problems are addressed before closing.

They can negotiate with the seller to resolve issues or advise you on your legal options if a problem can’t be resolved. Early identification and proactive problem-solving are key to avoiding significant delays and potential legal battles.

Planning for Post-Purchase Expenses: How To Prepare To Buy A House In One Year

Source: keepingcurrentmatters.com

Buying a house is a significant financial commitment, and the purchase price is just the beginning. Successfully navigating homeownership requires careful planning for ongoing expenses that can easily catch new homeowners off guard. Understanding and budgeting for these costs is crucial to avoid financial strain and maintain a comfortable lifestyle.

Creating a Post-Purchase Budget

Developing a realistic budget for post-purchase expenses is paramount. This budget should encompass property taxes, homeowner’s insurance, and a dedicated fund for routine and unexpected maintenance and repairs. It’s wise to overestimate rather than underestimate these costs, creating a buffer for unforeseen circumstances. For example, you might estimate your annual property taxes based on the previous year’s assessment, but add a 5-10% contingency in case of reassessments.

Similarly, compare insurance quotes from multiple providers to ensure you are getting the best rate for your coverage. Finally, setting aside a monthly amount for maintenance—even if it’s just a small sum—is a proactive approach to prevent minor issues from escalating into expensive problems.

Managing Unexpected Home Repairs, How to prepare to buy a house in one year

Unexpected home repairs are an inevitable part of homeownership. A leaky roof, a malfunctioning appliance, or a burst pipe can quickly drain your savings. To mitigate the financial impact of such events, creating an emergency fund specifically for home repairs is highly recommended. Aim for a fund containing 3-6 months’ worth of anticipated home maintenance costs, or even more if your home is older or has known issues.

This fund acts as a safety net, allowing you to address necessary repairs without resorting to high-interest debt like credit cards. For example, a family who anticipates $1000 annually in maintenance costs should ideally have $3000-$6000 in their home repair emergency fund.

Establishing a Home Maintenance Schedule

Regular maintenance is key to preventing costly repairs down the line. A well-defined maintenance schedule helps you stay on top of tasks like gutter cleaning, appliance inspections, and seasonal checks. A simple checklist, broken down by season or month, can be immensely helpful. For instance, spring might involve inspecting and cleaning gutters, while fall could include preparing the heating system for colder weather.

Regularly inspecting your roof, foundation, and plumbing can also prevent small problems from becoming major and expensive issues. Consider creating a spreadsheet or using a home maintenance app to track scheduled tasks and their completion.

Potential Hidden Costs of Homeownership

Beyond the obvious expenses, several hidden costs can significantly impact your budget. These can include homeowner’s association (HOA) fees, if applicable, which can cover amenities and maintenance within a community. Closing costs, though initially incurred at purchase, can sometimes have unexpected additional fees associated with them. Unexpected pest infestations, requiring professional extermination, are another example of a hidden cost that can easily amount to hundreds or even thousands of dollars.

Finally, consider the costs associated with moving your belongings and any necessary upgrades or repairs needed before you can move in comfortably. Thorough research and pre-purchase inspections can help minimize some of these surprises, but it’s always wise to have a financial cushion.

Concluding Remarks

Source: site-static.com

Buying a house is a significant undertaking, but with careful planning and a proactive approach, the seemingly impossible one-year timeframe becomes achievable. Remember, this journey involves financial preparation, thorough research, and understanding the home-buying process inside and out. By following the steps Artikeld here, you’ll be well-equipped to navigate each stage confidently and secure your dream home within your target timeframe.

So, start saving, start planning, and start building your future home!