How to rent my house to insurance company – How to rent my house to an insurance company? It’s a question many homeowners ponder, opening doors to potentially lucrative and stable rental income. This guide navigates the process, from understanding different insurance company programs and preparing your property to negotiating the lease and managing the ongoing relationship. We’ll cover everything from legal and financial considerations to effective marketing strategies, ensuring you’re well-equipped to successfully lease your property to an insurance provider.

Successfully renting to an insurance company involves more than just finding a tenant; it requires understanding their specific needs and navigating the unique legal and financial aspects involved. This guide breaks down the process into manageable steps, offering practical advice and real-world examples to help you achieve a smooth and profitable rental arrangement.

Understanding Insurance Company Rental Programs

Renting your house to an insurance company can be a lucrative option, but understanding the various programs available is crucial. These programs often involve the company leasing your property to temporarily house individuals in need of relocation due to disasters or other unforeseen circumstances. Different programs exist, each with its own set of requirements and benefits.

Types of Insurance Company Rental Programs

Insurance companies don’t typically advertise specific “rental programs” in the way a property management company might. Instead, they contract with third-party companies or utilize internal departments to manage temporary housing needs for their policyholders. These arrangements often arise after events like hurricanes, wildfires, or other major catastrophes. The specific terms and conditions will vary greatly depending on the insurance company and the specific circumstances.

One common type involves short-term rentals to provide immediate housing, while another might involve longer-term leases for individuals whose homes have been significantly damaged.

Requirements and Eligibility Criteria

Eligibility for participating in an indirect rental arrangement with an insurance company is not something you directly apply for. Instead, your property might be selected by a third-party company contracted by the insurer or the insurance company itself. Factors considered include location (proximity to affected areas), property size and condition (suitability for temporary housing), and availability. The insurer will need proof of ownership, along with a thorough property inspection to ensure it meets safety and habitability standards.

The rental agreement will be between you and the third-party company or the insurance company itself, and the terms will be negotiated individually.

Benefits and Drawbacks of Participating

A major benefit is the potential for consistent rental income, especially in areas prone to natural disasters. The rental period might be longer than typical short-term rentals, providing more financial stability. However, there are potential drawbacks. The rental rate might be negotiated at a lower rate than market value, especially in emergency situations where demand outweighs supply.

There’s also the potential for damage to your property, and the insurance company’s liability for repairs might be limited or contingent upon the circumstances of the initial damage. Additionally, the administrative burden of managing a lease with a large insurance company or its intermediary can be more complex than a typical landlord-tenant relationship.

Examples of Insurance Companies Involved

Specific insurance companies rarely publicly advertise their temporary housing programs, as they are often reactive and tied to specific disaster relief efforts. Large national insurers, such as State Farm, Allstate, and Farmers Insurance, often utilize such programs to assist their policyholders after catastrophic events. However, the actual process of leasing to them usually involves a third-party vendor, property management company, or a dedicated department within the insurance company itself.

It’s not a direct landlord-tenant relationship with the insurance company in most cases.

Preparing Your Property for Rental to an Insurance Company

Source: jumbomortgagesource.com

Getting your property ready for rental to an insurance company requires a strategic approach. You need to present a safe, well-maintained property that minimizes risk and aligns with their specific needs. This involves more than just a fresh coat of paint; it’s about demonstrating proactive risk management and a commitment to maintaining a high standard of safety.

Necessary Repairs and Improvements Checklist

Insurance companies prioritize safety and minimizing potential claims. Therefore, addressing any existing issues is crucial. A thorough inspection is the first step. This checklist highlights key areas to focus on:

- Roofing: Repair or replace damaged shingles, ensure proper drainage, and check for leaks. A well-maintained roof significantly reduces the risk of water damage claims.

- Plumbing: Inspect all pipes, fixtures, and appliances for leaks or malfunctions. Address any issues promptly to prevent water damage and mold growth.

- Electrical Systems: Ensure all wiring is up to code, outlets are functional, and there are no exposed wires. Outdated electrical systems pose a significant fire hazard.

- HVAC Systems: Regular maintenance and repairs are essential for efficient heating and cooling. A malfunctioning system can lead to costly repairs and discomfort.

- Structural Integrity: Check for cracks in walls, foundations, or floors. Addressing structural issues prevents further damage and potential safety hazards.

- Security Systems: Install or upgrade security systems, including smoke detectors, carbon monoxide detectors, and security cameras. These systems reduce the risk of theft and fire-related incidents.

- Appliances: Ensure all appliances are in good working order and meet safety standards. Replace any outdated or malfunctioning appliances.

- Landscaping: Maintain a well-kept lawn and remove any hazards such as overgrown trees or shrubs that could cause damage or injury.

Marketing Strategy for Insurance Company Rentals

Highlighting your property’s suitability for insurance company needs requires a targeted marketing approach. Focus on the aspects that minimize their risk and demonstrate your commitment to property maintenance.

- Emphasize Safety Features: Showcase the upgraded security systems, smoke detectors, and other safety features in your marketing materials.

- Document Preventative Maintenance: Provide detailed records of all recent repairs and maintenance work performed on the property.

- Highlight Low-Risk Profile: Emphasize the property’s location in a low-crime area with minimal risk of natural disasters.

- Target Insurance Companies Directly: Research insurance companies that specialize in property rentals and tailor your marketing materials to their specific requirements.

- Professional Photography: High-quality photos showcasing the property’s condition and safety features are essential for attracting potential renters.

Examples of Successful Property Presentations

A successful presentation emphasizes proactive risk mitigation. For example, a property with detailed documentation of recent roof repairs and a newly installed security system will be more attractive than one with deferred maintenance. Another example would be a property in a desirable, low-risk neighborhood with well-maintained landscaping, demonstrating a commitment to ongoing upkeep. The key is to showcase a property that is ready to occupy with minimal upfront investment for the insurance company.

Preparing Necessary Documentation

Thorough documentation is crucial for a smooth rental process. This step-by-step guide will help:

- Property Inspection Report: Obtain a detailed inspection report from a qualified professional, highlighting the property’s condition and any necessary repairs.

- Maintenance Records: Compile detailed records of all past and present maintenance and repair work performed on the property.

- Insurance History: Provide a history of insurance claims made on the property, if any.

- Property Tax Records: Provide current property tax assessment and payment records.

- Lease Agreement: Prepare a comprehensive lease agreement outlining all terms and conditions of the rental.

- Rental Application: Develop a thorough rental application to collect all necessary information from the insurance company.

Negotiating the Rental Agreement

Source: tgsinsurance.com

Negotiating a rental agreement with an insurance company requires a strategic approach. Understanding their needs and your leverage is crucial to reaching a mutually beneficial agreement. This involves careful consideration of several key factors, from the rental rate to the specifics of responsibilities during the lease.

Successful negotiation hinges on clear communication, a well-prepared property, and a realistic understanding of market rates. It’s a process that benefits from professional guidance, especially when dealing with the complexities of insurance company contracts.

Rental Rate Determination

Determining a fair rental rate involves researching comparable properties in your area that have been rented to insurance companies. Consider factors like property size, location, condition, and amenities. Online property listings and real estate agents can provide valuable data. You might also consider the length of the lease; longer-term leases often command slightly lower rates, while shorter-term leases may fetch a premium.

Remember, your goal is to find a rate that reflects the market value while ensuring a profitable arrangement for you. An overly ambitious rate might deter the insurance company, while a rate that’s too low could leave money on the table.

Lease Term Negotiation

The lease term is a significant negotiation point. Insurance companies often prefer longer-term leases for stability and cost predictability. However, you might prefer shorter terms to maintain flexibility. Finding a compromise that suits both parties is key. For example, a five-year lease with options for renewal every year might be a suitable compromise.

Consider incorporating clauses that address potential changes in market conditions or unforeseen circumstances. A well-drafted lease should explicitly Artikel the terms of renewal, termination, and any associated penalties.

Responsibilities and Liability

Clearly defining responsibilities and liabilities is crucial to avoid disputes. The lease agreement should specify who is responsible for maintenance, repairs, and property insurance. Insurance companies typically require comprehensive insurance coverage. Negotiate the level of responsibility for maintenance and repairs; you might agree to handle minor repairs, while the insurance company covers major ones exceeding a specific cost threshold.

Be clear on liability in case of damage caused by the insurance company’s use of the property. This section of the agreement should be thoroughly reviewed by legal counsel to ensure all parties are adequately protected.

Potential Challenges and Solutions

Negotiations can encounter unexpected hurdles. For example, disagreements over property valuation, repair costs, or lease terms might arise. Open communication and a willingness to compromise are vital in overcoming these challenges. Seeking professional advice from a real estate agent or attorney can provide valuable support and guidance during difficult negotiations. Documenting all agreements and communications is crucial to avoid future misunderstandings.

If disagreements persist, consider mediation as a way to reach a resolution before resorting to legal action.

Successful Negotiation Strategies

Successful negotiation often involves thorough preparation and a strategic approach. Researching market rates and comparable properties beforehand strengthens your position. Presenting a well-maintained property increases its appeal and justifies a higher rental rate. Being flexible and willing to compromise while firmly advocating for your interests is crucial. Presenting multiple options and demonstrating a collaborative approach often leads to a more favorable outcome.

For example, offering a slightly lower rate in exchange for a longer lease term can be a beneficial strategy.

Importance of Legal Counsel

Legal counsel is invaluable during the rental agreement process. A lawyer can review the contract to ensure it protects your interests, addresses potential liabilities, and complies with all relevant laws and regulations. They can advise you on acceptable lease terms, identify potential risks, and negotiate favorable clauses. The cost of legal counsel is a worthwhile investment considering the potential financial and legal implications of an improperly drafted agreement.

This is especially important when dealing with the complexities and potential liabilities involved in renting to an insurance company.

Managing the Rental Relationship

Source: googleapis.com

Successfully renting your property to an insurance company requires ongoing communication and proactive management. A strong, positive relationship built on clear expectations and prompt responses to issues will ensure a smooth rental period for both parties. This section details the responsibilities of both you and the insurance company, Artikels a communication plan, and provides strategies for efficient maintenance and conflict resolution.

Both you and the insurance company have distinct responsibilities throughout the lease. The insurance company is responsible for paying rent on time, adhering to the terms of the lease agreement, and maintaining the property in a reasonable condition, considering its use as temporary housing for individuals involved in insured events. You, as the property owner, are responsible for providing a safe and habitable dwelling, addressing maintenance requests promptly and efficiently, and adhering to all applicable landlord-tenant laws.

Responsibilities of the Property Owner and Insurance Company, How to rent my house to insurance company

Understanding each party’s responsibilities is crucial for a successful rental. A well-defined lease agreement outlining these responsibilities is the cornerstone of a positive relationship. This agreement should specify the insurance company’s obligations regarding property damage, maintenance, and occupancy. It should also detail your responsibilities regarding repairs, maintenance, and access to the property. For example, the agreement might state the insurance company’s responsibility for reporting damage promptly and your obligation to respond within a specified timeframe.

Sample Communication Plan

Regular communication is key to preventing misunderstandings and resolving issues quickly. A simple communication plan can significantly improve the relationship. This plan should include methods of contact, response times, and escalation procedures for unresolved issues.

- Primary Contact Method: Email is usually efficient for documenting communication. Include phone numbers for urgent matters.

- Response Time: Aim to respond to emails within 24 hours and phone calls within a few hours, except in cases of emergencies. The lease should specify these response times.

- Regular Check-ins: Schedule monthly brief check-ins (email or phone call) to discuss any issues or concerns. This proactive approach fosters open communication.

- Escalation Procedure: Designate a point of contact for both parties, and establish a clear escalation path if issues cannot be resolved directly. This might involve contacting a property manager or the insurance company’s designated representative.

Handling Maintenance Requests and Repairs

Establishing a clear process for handling maintenance requests is crucial. This ensures timely repairs and prevents minor issues from escalating into major problems. A streamlined process fosters a positive rental experience.

- Request Method: Specify how maintenance requests should be submitted (e.g., email, online portal). Include a detailed description of the issue.

- Response Time: Establish a timeframe for acknowledging the request and for completing the repair. Consider factors like the urgency and availability of contractors.

- Repair Process: Artikel the process for obtaining quotes, selecting contractors, and overseeing repairs. The lease should detail who is responsible for the cost of repairs.

- Emergency Repairs: Clearly define emergency situations (e.g., plumbing leaks, electrical fires) and the procedure for handling them. This might involve 24/7 contact information for an emergency service.

Resolving Conflicts or Disagreements

Disagreements can arise, but a proactive approach to conflict resolution is essential. This ensures a positive relationship throughout the lease period. The best approach is to address concerns immediately and constructively.

- Open Communication: Encourage open and honest communication to address concerns promptly. This helps prevent minor issues from escalating.

- Mediation: If direct communication fails, consider using a neutral third party to mediate the disagreement. This can help find a mutually agreeable solution.

- Legal Recourse: As a last resort, legal action might be necessary. This should be avoided if possible, but having a clear understanding of legal options is important.

Legal and Financial Aspects

Renting your property to an insurance company, while potentially lucrative, involves navigating several legal and financial considerations. Understanding these aspects beforehand is crucial for a smooth and profitable transaction. This section Artikels the key legal implications, tax implications, insurance requirements, and provides a basic financial model for projecting your rental income and expenses.

Legal Implications of Renting to an Insurance Company

Renting to an insurance company involves a standard landlord-tenant relationship, but with some unique aspects. It’s essential to have a comprehensive and legally sound rental agreement that addresses specific issues like the purpose of the rental (e.g., temporary housing for disaster victims, or long-term storage), potential liability for damages beyond normal wear and tear, and the duration of the lease.

Consult with a real estate attorney to ensure your agreement protects your interests and complies with all applicable local, state, and federal laws. Consider including clauses that specifically address the potential for high occupancy turnover, unusual wear and tear, and the insurance company’s responsibilities regarding property maintenance. Failure to address these points could lead to disputes and financial losses.

Tax Implications and Financial Considerations

Renting out your property generates rental income, which is taxable. The Internal Revenue Service (IRS) provides detailed guidelines on deducting expenses related to the property, such as mortgage interest, property taxes, insurance, repairs, and depreciation. Accurate record-keeping is paramount. You’ll need to track all income and expenses meticulously to file accurate tax returns. Consult a tax professional to determine the most advantageous tax strategies for your situation, considering factors like your overall income and tax bracket.

They can help you understand deductions, depreciation methods, and potential tax credits. For example, you might be able to deduct a portion of your mortgage interest, property taxes, and insurance premiums. Depreciation allows you to deduct a portion of the property’s value over its useful life, reducing your taxable income.

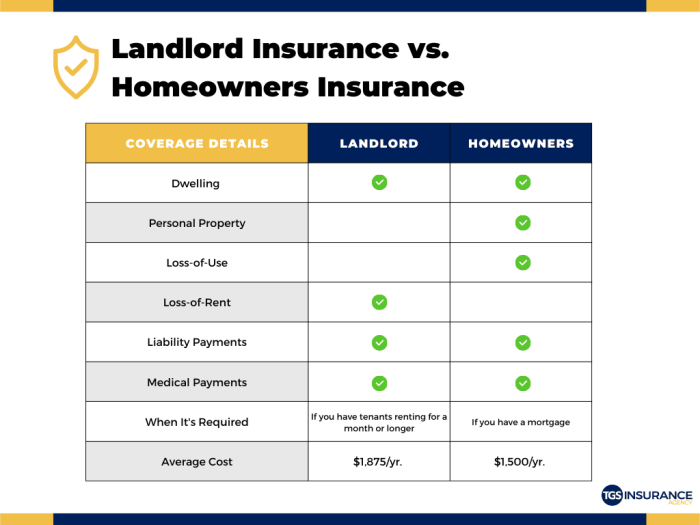

Insurance Requirements and Liability Considerations

Adequate insurance coverage is crucial for both you and the insurance company renting your property. Your existing homeowner’s insurance policy might not suffice. You’ll likely need to obtain a landlord insurance policy that covers potential liabilities related to tenant-related incidents or property damage. The insurance company renting your property will also likely have its own insurance policies covering their operations and potential liabilities within your property.

Clearly define the responsibilities of each party regarding insurance coverage in the rental agreement. Consider liability coverage for injuries on the property, damage to the property, and potential legal disputes. This might require obtaining supplemental insurance or adjusting your existing policy to reflect the unique aspects of renting to an insurance company.

Financial Model for Rental Income and Expenses

A simple financial model can help you project profitability. This model considers annual rental income, annual expenses, and annual net income.

| Item | Annual Amount ($) |

|---|---|

| Annual Rental Income | [Insert Estimated Annual Rental Income] |

| Property Taxes | [Insert Estimated Annual Property Taxes] |

| Homeowners Insurance | [Insert Estimated Annual Homeowners Insurance] |

| Maintenance & Repairs | [Insert Estimated Annual Maintenance & Repairs] |

| Mortgage Payments (if applicable) | [Insert Estimated Annual Mortgage Payments] |

| Utilities (if included in rental agreement) | [Insert Estimated Annual Utilities] |

| Other Expenses | [Insert Estimated Annual Other Expenses] |

| Total Annual Expenses | [Sum of all expenses] |

| Annual Net Income | [Annual Rental Income – Total Annual Expenses] |

Note: This is a simplified model. A more comprehensive model would incorporate factors like vacancy rates, potential capital expenditures, and inflation. It is crucial to consult with a financial professional for personalized advice.

Marketing and Finding Tenants

Finding the right insurance company tenant for your property requires a targeted marketing approach. You’re not just looking for any renter; you need a company with a proven track record of responsible property management and a strong financial standing. This section Artikels strategies to effectively market your property and locate suitable tenants within the insurance industry.

Your marketing plan should focus on reaching the specific decision-makers within insurance companies who are responsible for securing temporary housing for employees or handling disaster relief accommodations. Think beyond general rental listings; you need to directly target this niche market.

Marketing Strategies for Insurance Companies

Effective marketing involves highlighting the unique aspects of your property that appeal to insurance companies’ specific needs. This includes emphasizing factors such as location (proximity to disaster zones or employee hubs), property size and configuration (ability to accommodate multiple families or individuals), security features, and the overall condition of the property. A professional and comprehensive presentation will significantly improve your chances of securing a tenant.

Compelling Property Descriptions and Visuals

High-quality photos and a detailed property description are essential. Your description should go beyond the basics. Include specific details like the number of bedrooms and bathrooms, square footage, included appliances, parking availability, and any unique features. Photographs should showcase the property’s best features, highlighting cleanliness, functionality, and overall appeal. Consider including a virtual tour for a more immersive experience.

For example, a photo could show a spacious, well-lit living room with comfortable furniture, emphasizing the comfortable living space available for employees needing temporary housing. Another photo could focus on a secure, fenced backyard, highlighting safety for families.

Online and Offline Resources for Finding Tenants

Reaching insurance companies requires a multi-pronged approach.

Utilizing both online and offline resources significantly increases your chances of finding a suitable tenant. A targeted strategy ensures you reach the right audience.

- Online Resources: Specialized commercial real estate websites catering to corporate rentals, targeted online advertising campaigns on platforms frequented by insurance professionals (LinkedIn, industry-specific websites), and direct outreach to insurance companies via their websites.

- Offline Resources: Networking at industry events, attending insurance conferences (if feasible), and reaching out to local insurance brokers or agents. Direct mail marketing to specific insurance companies in your area can also be effective.

Examples of Successful Marketing Campaigns

While specific details of successful campaigns are often confidential, the underlying principles remain consistent. A successful campaign typically involves:

- Targeted Advertising: Focusing on s and demographics relevant to insurance companies and their needs for temporary housing solutions. For example, a targeted online ad campaign could focus on s like “corporate housing,” “temporary relocation,” and “disaster relief accommodations.”

- Professional Presentation: High-quality photographs, detailed property descriptions, and a well-designed marketing brochure or website showcasing the property’s suitability for corporate rentals.

- Strong Networking: Building relationships with insurance brokers and agents to create a pipeline of potential tenants.

Illustrative Examples (Table Format): How To Rent My House To Insurance Company

Source: pcdn.co

Understanding the specifics of different insurance company rental programs can be challenging. This table provides a simplified comparison of three hypothetical programs to illustrate the variations you might encounter. Remember that actual programs offered by insurance companies will vary significantly. Always review the specific terms and conditions of any program before entering into an agreement.This comparison highlights key differences in rental requirements, lease term options, and payment structures.

These are crucial factors to consider when choosing a program that best suits your property and financial goals.

Insurance Program Comparison

| Program Name | Rental Requirements | Lease Term Options | Payment Structure |

|---|---|---|---|

| SecureHome Rentals | Minimum credit score of 680, proof of income, background check, property inspection. May require specific upgrades based on inspection. | 6-month, 12-month, 18-month leases available. | Monthly rent payments, paid in advance. Security deposit equal to one month’s rent. |

| First Response Housing | Minimum credit score of 700, proof of income, background check, property inspection, homeowners insurance verification. | 12-month lease only. Option to renew annually. | Monthly rent payments, paid in advance. Security deposit equal to two month’s rent. Additional cleaning fee at lease end. |

| National Relocation Solutions | More flexible credit score requirements (case-by-case basis), proof of income, background check, property inspection. May accept co-signers. | 6-month, 12-month, 24-month leases available. | Monthly rent payments, paid in advance. Security deposit equal to one and a half month’s rent. Potential for rent increases after the initial lease term. |

Illustrative Examples (Descriptions)

Source: amazonaws.com

Let’s look at three real-world examples of successful insurance company rentals, each showcasing different challenges and how they were overcome. These scenarios illustrate the diverse situations you might encounter and the adaptable strategies needed for a smooth rental experience.

Scenario 1: Post-Hurricane Property Rehabilitation and Rental

This case involved a beachfront property in Florida significantly damaged by a hurricane. The owner, unable to afford immediate repairs, partnered with an insurance company specializing in disaster recovery rentals. The insurance company covered the cost of repairs in exchange for a long-term lease, using the property to house their adjusters and other personnel involved in the post-hurricane assessment and rebuilding efforts.

The challenge here was the extensive damage and the need for swift repairs to meet the insurance company’s timeline. The solution involved a detailed damage assessment, securing multiple contractor bids, and establishing a clear communication channel with the insurance company to expedite the repair process. The owner benefited from having their property restored at no upfront cost, and the insurance company secured essential housing near the disaster zone.

Scenario 2: Long-Term Lease for Employee Housing in a Remote Area

An insurance company with a large regional office in a rural area with limited housing options needed to provide accommodation for newly hired employees. They leased a cluster of houses from a property owner for a five-year period. The challenge was ensuring the properties met the company’s standards for employee comfort and safety, and managing maintenance across multiple properties.

The solution involved a detailed pre-rental inspection with a checklist addressing safety, functionality, and aesthetics. A robust maintenance agreement was put in place, outlining the responsibilities of both parties and establishing a clear process for reporting and resolving maintenance issues. This ensured employee satisfaction and minimized disruption for the insurance company.

Scenario 3: Temporary Housing for Disaster Relief Workers

Following a major earthquake, an insurance company needed temporary housing for its claims adjusters and other personnel deployed to the affected area. They secured a short-term lease on a large apartment complex from a property management company. The challenge was the urgency of securing housing quickly and ensuring the properties were readily available and met the immediate needs of the relief workers.

The solution involved leveraging established relationships with property management companies, negotiating favorable lease terms for a short duration, and prioritizing properties with readily available utilities and basic amenities. This ensured the insurance company could swiftly deploy its workforce and begin the claims process without delay.

Final Review

Source: slidesharecdn.com

Renting your house to an insurance company can be a rewarding venture, offering a potentially stable and lucrative income stream. By carefully preparing your property, understanding the specific needs of insurance companies, and navigating the legal and financial considerations, you can confidently secure a successful rental agreement. Remember, thorough planning and proactive communication are key to a positive and productive landlord-tenant relationship.

This guide has provided the tools; now it’s time to put them to use and find the perfect tenant for your property.